What Is Covered By Third-Party Car Insurance?

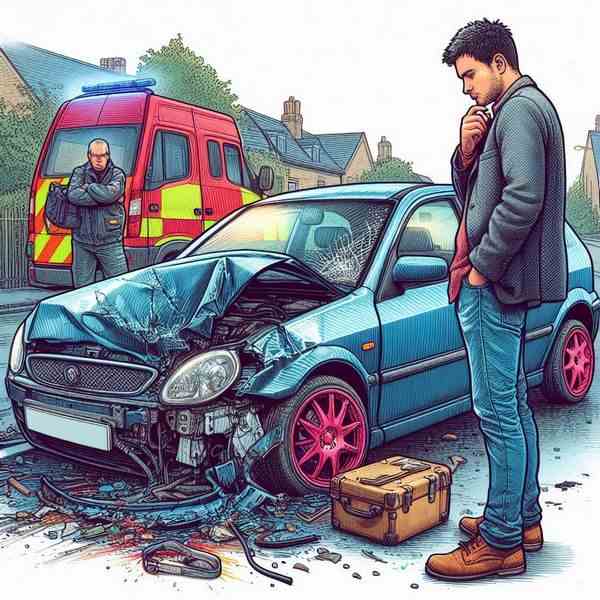

Third-party car insurance is the minimum legal requirement to drive in the UK, but it offers much less cover compared to a comprehensive policy. This type of cover only provides protection for damage or injury caused to others in an accident you're at fault for. Unfortunately, any damage to your own car won't be covered, meaning you could be left with hefty repair bills. Typically, third-party insurance could cover:

- Damage to another person's vehicle or property

- Injury to others involved in an accident caused by you

- Legal claims made against you for third-party damage or injury

Does Third-Party, Fire And Theft Provide Enough Cover?

Third-party, fire, and theft (TPFT) insurance is an additional option that offers slightly more protection than basic third-party cover. In addition to covering damage or injury to others, TPFT includes protection against fire damage and theft of your car. However, it still doesn't offer protection for accidental damage to your own vehicle in an accident. It's a middle-ground option for those wanting a bit more cover without opting for full comprehensive insurance.

Which Type Of Insurance Offers The Best Value?

Deciding between comprehensive and third-party cover can come down to a balance between cost and protection. Whilst third-party insurance tends to have lower premiums, it's important to consider what's at risk. If you rely on your car for daily use or have a newer, more expensive vehicle, comprehensive cover may offer peace of mind by covering a wider range of incidents. However, if your car is older and less valuable, third-party or TPFT could be a more affordable option. Think carefully about what matters more-lower premiums or better protection.

Will Choosing Comprehensive Insurance Always Be More Expensive?

Interestingly, fully comprehensive insurance isn't always more expensive than third-party options. Insurers often see those opting for third-party cover as higher risk, which can sometimes result in higher premiums. It's always worth comparing quotes for both types of cover to look for out which gives you the best value for your specific situation. Shopping around is key to Looking for the right policy at the best price.

To explore your options and see how different policies stack up, compare car insurance quotes today and research options for a policy that suits your needs.

Why not get quotes now?